Lunch Wrap: ASX inches up, copper stocks rally after Ivanhoe shuts Congo mine

Steve made up for his height challenges with unbridled enthusiasm. Picture via Getty Images (and Overactors Anonymous, presumably)

- ASX edges up as Europe rallies on tariff truce

- Ivanhoe tremors jolt copper stocks higher

- Telstra plots leaner, meaner five-year plan

The ASX tiptoed modestly higher Tuesday morning, up by just 0.15%.

With Wall Street and London both closing for the long weekend, local traders took their cue from the Old Continent, where stocks jumped after Trump hit pause on his 50% EU tariff threats.

Nasdaq 100 futures also climbed, feeding optimism into tech-heavy local names like WiseTech Global (ASX:WTC) and Technology One (ASX:TNE) this morning.

One stock to watch this week is Nvidia. The chip king reports its results Wednesday US time, and markets will be hanging on every word to see if the AI boom still has legs.

Also on deck is the all-crucial US Fed’s preferred inflation gauge, the PCE index, due Friday. A soft read here could give equities another lift.

Back home on the ASX, the spark this morning came from copper stocks.

Capstone Copper Corp (ASX:CSC) jumped 6.5% and Sandfire Resources (ASX:SFR) added 2.5% after Canadian giant Ivanhoe Mines pulled its guidance from its flagship Congo project, Africa’s biggest copper mine.

Ivanhoe said underground tremors over the weekend forced another shutdown at the Kakula mine. No one was hurt, but the situation is dicey with seismic jolts still hitting.

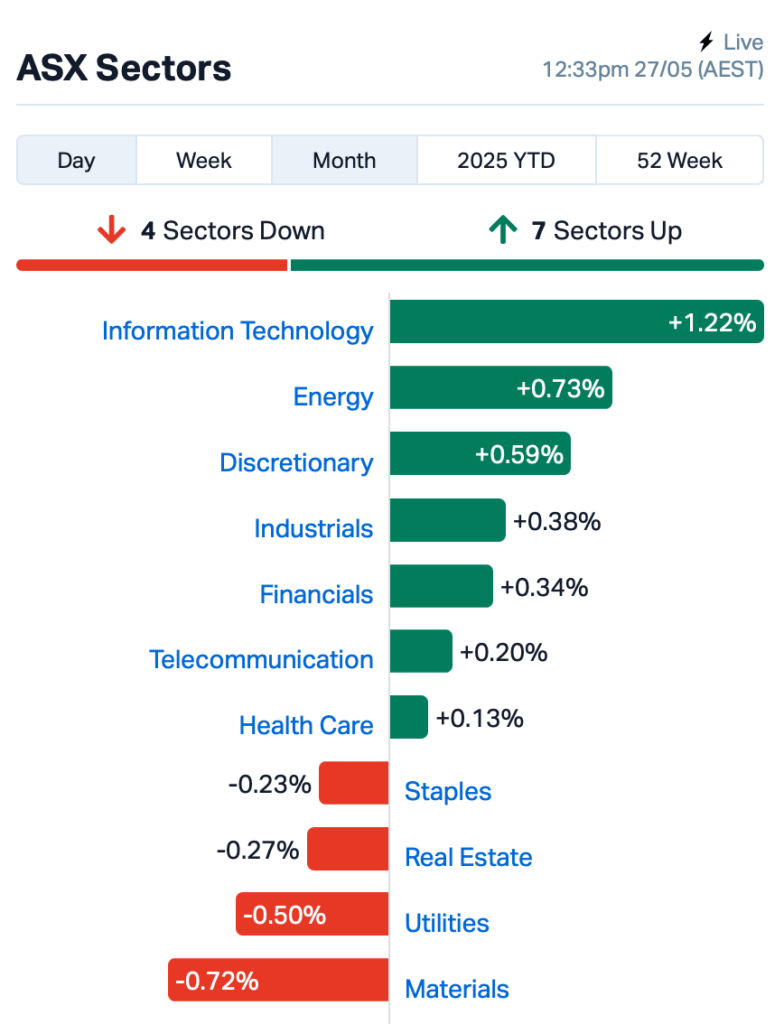

This is where things stood at about 12:30pm AEST:

In large caps news, Telstra (ASX:TLS) dipped 0.5% after unveiling a new five-year plan. TLS is lifting its return-on-invested-capital target to 10% by 2030, up from 8%, and wants earnings to grow faster than costs.

Insurance Australia (ASX:IAG) gave the market an early look at flood impacts from the NSW mid-north coast and Hunter region, tallying about 2,500 claims so far. It’s too soon for a final bill, but the insurer noted its net costs were sitting at $900 million by end of April.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 27 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| IFG | Infocus Group | 0.011 | 120% | 58,368,339 | $1,312,134 |

| AAU | Antilles Gold Ltd | 0.006 | 100% | 14,488,082 | $6,379,103 |

| BMO | Bastion Minerals | 0.0015 | 50% | 3,500,000 | $903,628 |

| DTM | Dart Mining NL | 0.004 | 33% | 14,968,168 | $3,594,167 |

| TKL | Traka Resources | 0.002 | 33% | 500,000 | $3,188,685 |

| VPR | Voltgroupltd | 0.002 | 33% | 650,000 | $16,074,312 |

| DTR | Dateline Resources | 0.072 | 31% | 102,352,401 | $155,089,566 |

| SHN | Sunshine Metals Ltd | 0.0085 | 21% | 8,287,232 | $14,613,514 |

| HIO | Hawsons Iron Ltd | 0.019 | 19% | 1,979,893 | $16,264,022 |

| A1G | African Gold Ltd. | 0.16 | 19% | 1,423,317 | $64,802,677 |

| DXN | DXN Limited | 0.035 | 17% | 2,032,316 | $8,961,109 |

| TMK | TMK Energy Limited | 0.0035 | 17% | 251,278 | $30,667,149 |

| YAR | Yari Minerals Ltd | 0.007 | 17% | 2,803,749 | $3,328,269 |

| AUG | Augustus Minerals | 0.029 | 16% | 408,484 | $2,979,786 |

| CVR | Cavalier Resources | 0.19 | 15% | 62,666 | $9,543,966 |

| D3E | D3 Energy Limited | 0.115 | 15% | 25,000 | $7,947,501 |

| OIL | Optiscan Imaging | 0.125 | 14% | 247,732 | $91,887,488 |

| SYA | Sayona Mining Ltd | 0.017 | 13% | 55,151,481 | $173,149,440 |

| BVR | Bellavista Resources | 0.35 | 13% | 16,993 | $31,273,592 |

| PCK | Painchek Ltd | 0.054 | 13% | 1,635,674 | $88,412,102 |

| SRI | Sipa Resources Ltd | 0.0135 | 13% | 4,952,177 | $4,996,780 |

| STK | Strickland Metals | 0.135 | 13% | 12,916,873 | $271,483,176 |

| TAT | Tartana Minerals Ltd | 0.045 | 13% | 44,444 | $8,565,836 |

| FBM | Future Battery | 0.018 | 13% | 536,953 | $10,700,895 |

InFocus Group Holdings (ASX:IFG) has locked in a juicy US$3.25 million contract to build an end-to-end iGaming platform for Taiwanese outfit TG Solutions. It’s the second big win for InFocus in the digital gaming space. The platform will be white-labelled for TG’s customers and packed with features like real-time odds (inspired by Polymarket), crypto payments, tokenised rewards, digital collectibles, and AI-powered analytics.

Antilles Gold (ASX:AAU) has signed two offtake deals for all the gold and copper-gold concentrate from its Nueva Sabana mine in Cuba. The buyer is a major global commodities trader, and the gold pricing has come in 12% above what was in the original feasibility study. The contracts run for the mine’s 4.5-year life, with shipments expected every two weeks and fast payments based on global metal prices.

Dateline Resources (ASX:DTR) has found signs the gold system at its Colosseum Project in California could run deeper and wider than first thought. New sampling west of the old pits shows strong geochemical markers pointing to hidden breccia pipes. Most of the ground has never been properly tested, and a rare earths project review is due in early June.

Sunshine Metals (ASX:SHN) is picking up the high-grade Sybil gold project in Queensland, locking in a $1.225 million deal from an unrelated, private party. Sybil is near Charters Towers and has strong early hits, including 7m at 10.6g/t gold and rock chips grading up to 907g/t. It hasn’t seen much action in 20 years, but SHN reckons it looks a lot like the nearby 4Moz Pajingo system.

Vulcan Energy Resources (ASX:VUL) has fired up drilling on the fifth well of its Lionheart lithium project in Schleidberg. The company says full execution, including pipeline and plant works, will kick off once financing is sorted. It’s aiming to pump out 24,000 tonnes of lithium hydroxide monohydrate per year.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 27 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LNR | Lanthanein Resources | 0.001 | -50% | 113,750 | $4,887,272 |

| AOK | Australian Oil | 0.002 | -33% | 726,153 | $3,005,349 |

| CZN | Corazon Ltd | 0.001 | -33% | 460,000 | $1,776,858 |

| ALM | Alma Metals Ltd | 0.003 | -25% | 325,110 | $6,345,381 |

| AW1 | American West Metals | 0.04 | -22% | 3,835,385 | $30,382,869 |

| HLX | Helix Resources | 0.002 | -20% | 465,000 | $8,410,484 |

| JAV | Javelin Minerals Ltd | 0.002 | -20% | 100,000 | $15,115,373 |

| FCT | Firstwave Cloud Tech | 0.014 | -18% | 258,457 | $29,129,818 |

| MEL | Metgasco Ltd | 0.0025 | -17% | 373,000 | $4,372,760 |

| OVT | Ovanti Limited | 0.0025 | -17% | 4,133,795 | $8,380,545 |

| VEN | Vintage Energy | 0.005 | -17% | 863,620 | $11,982,791 |

| VML | Vital Metals Limited | 0.0025 | -17% | 700,000 | $17,685,201 |

| BUS | Bubalusresources | 0.11 | -15% | 257,500 | $7,330,047 |

| CML | Connected Minerals | 0.14 | -15% | 70,873 | $6,824,105 |

| CBE | Cobre | 0.036 | -14% | 1,404,782 | $18,464,878 |

| AN1 | Anagenics Limited | 0.006 | -14% | 1,223,965 | $3,474,243 |

| ARV | Artemis Resources | 0.006 | -14% | 1,051,327 | $17,699,705 |

| FAU | First Au Ltd | 0.003 | -14% | 250,000 | $7,251,976 |

| GLL | Galilee Energy Ltd | 0.006 | -14% | 1,271,297 | $4,950,350 |

| RDN | Raiden Resources Ltd | 0.006 | -14% | 2,037,572 | $24,156,240 |

| TYX | Tyranna Res Ltd | 0.003 | -14% | 57,308 | $11,509,489 |

| ADG | Adelong Gold Limited | 0.007 | -13% | 2,094,296 | $11,179,890 |

| ADO | Anteotech Ltd | 0.007 | -13% | 1,544,048 | $21,642,403 |

| AX8 | Accelerate Resources | 0.007 | -13% | 110,300 | $6,377,510 |

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.