Gold resource upgrade takes Nordic to the brink of the 1Moz milestone

Nordic Resources has boosted its gold inventory in Finland after validating the JORC compliance of the Angesneva resource. Pic: Getty Images

- Nordic Resources adds Angesneva resource within the Kiimala Trend project area to its Finland gold inventory

- Angesneva adds 147,000oz, starting from surface, increasing total gold resources in the country to 961,800oz

- Proposed 2025 drilling to test the parallel structures at Angesneva and potentially bring Vesipera, another advanced prospect at Kiimala, to JORC compliance

Special Report: The “secondary” Kiimala Trend gold project in Finland is looking to be worth every penny Nordic Resources will pay for it after a significant maiden resource was defined.

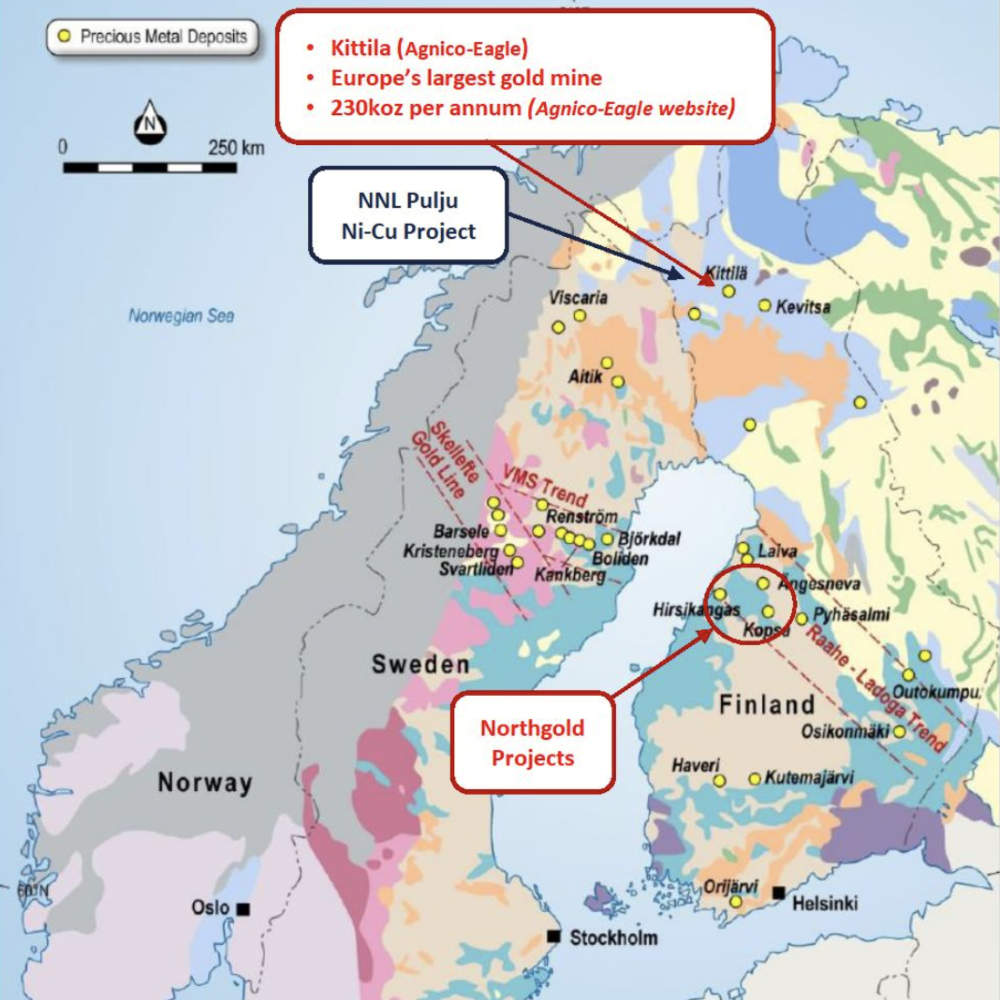

Kiimala Trend is one of three projects along the underexplored Middle Ostrobothnia gold belt the company agreed to buy in mid-April for $330,000 in cash and shares representing a 32% stake to shareholders in the Swedish-listed vendor Northgold.

At that time, Nordic Resources (ASX:NNL) was quite rightly focused on the near-surface Kopsa project with its JORC resource of 23.2Mt at 1.09g/t gold equivalent for 814,800oz contained AuEq.

That 69% of this was within the higher confidence measured and indicated categories certainly didn’t hurt nor did the conditional mining lease and auxiliary mining lease already under application.

While the company considered the other two projects – Kiimala Trend and Hirsikangas – to also be prospective, it got an inkling of just how rich the former could be while reviewing historical data.

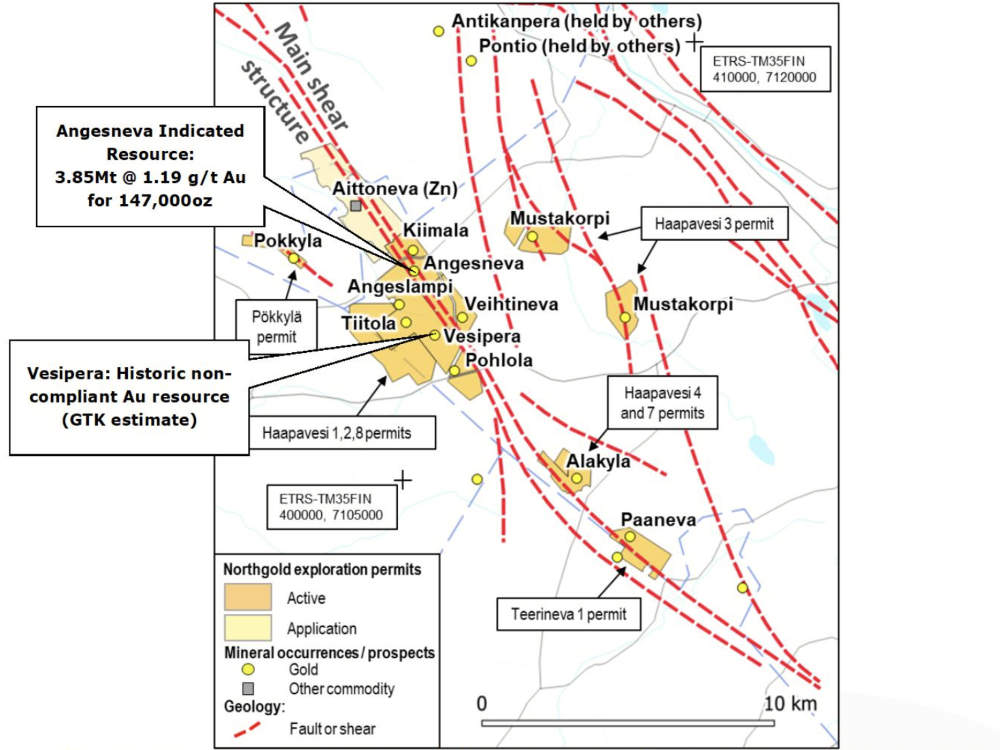

Kiimala Trend consists of eight drilled and four undrilled prospects along a discontinuous 15km trend.

All eight of the prospects drilled to date returned significant near-surface gold intersections while two – Angesneva and Vesipera – had historical, non-JORC resources.

The review uncovered multiple thick zones of gold mineralisation topping at 122m grading 1.52g/t gold and 0.12% copper starting from a down-hole depth of just 57.2m at Angesneva while Vesipera yielded shallower but higher-grade intersections such as 10.4m at 4.93g/t gold from 53.5m.

At the northernmost Kiimala prospect, a top intersection of 17.3m at 2.27g/t gold and 0.28% copper from 42.6m was noted.

Closing in on magic million ounces

The company has now locked in at least some of the gold resources defined to date at Kiimala Trend.

It has verified that an indicated resource of 3.85Mt at 1.19g/t gold, or 147,000oz of contained gold, for the Angesneva prospect that was defined in accordance with the older JORC 2004 code also meets the requirements of the current JORC 2012.

As such, the resource can now be included in the company’s central Finland gold inventory, taking its total resources in the district to within sneezing distance of the magic million ounce mark where banks and other financial providers start taking things seriously.

NNL now has a total resource inventory of 961,800oz at an average grade of 1.11g/t of which a whopping 74% is in the measured and indicated categories.

That Angesneva is a near-surface orogenic gold deposit near existing third-party plants that offer potential processing options certainly doesn’t hurt.

“The additional gold resource ounces at Angesneva deliver immediate upside, bringing the total gold equivalent resource inventory to almost 1Moz AuEq, with 74% in the measured and indicated categories, and its proximity to Kopsa adds significant value to the regional development options currently under consideration,” executive director Robert Wrixon said.

More from Nordic Resources: Three new Finnish acquisitions to bolster portfolio

More gold potential

The review also highlighted the potential for more gold to be found.

While the Angesneva resource may largely be closed off along strike, it remains open at depth.

Likewise, a nearby intersection of 19.2m at 1.37g/t gold in hole BELANG014 suggests that parallel structures with associated gold mineralisation might sit immediately to the northwest.

NNL noted that drilling at the prospect has been mostly confined to a single mineralised envelope, and the potential parallel structures in the footwall to the northwest have not been sufficiently tested.

Adding further interest, most holes at Kiimala Trend were drilled to depths of less than 100m with the few exceeding that largely targeting Angesneva.

This hints at the potential to uncover deeper mineralisation as the holes that correctly targeted the controlling structure reliably encountered significant gold mineralisation while deeper drilling at several prospects has encountered important higher-grade zones.

As such, the company proposed 2025 drilling at Kiimala Trend will test the prospective parallel structures at Angesneva for their gold potential.

It will also test the historical, non-JORC compliant resource at Vesipera, which is adjacent to Angesneva, to potentially bring it into compliance with the JORC 2012 standard.

A review of Hirsikangas – the third project the company is acquiring – is also underway.

This article was developed in collaboration with Nordic Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.