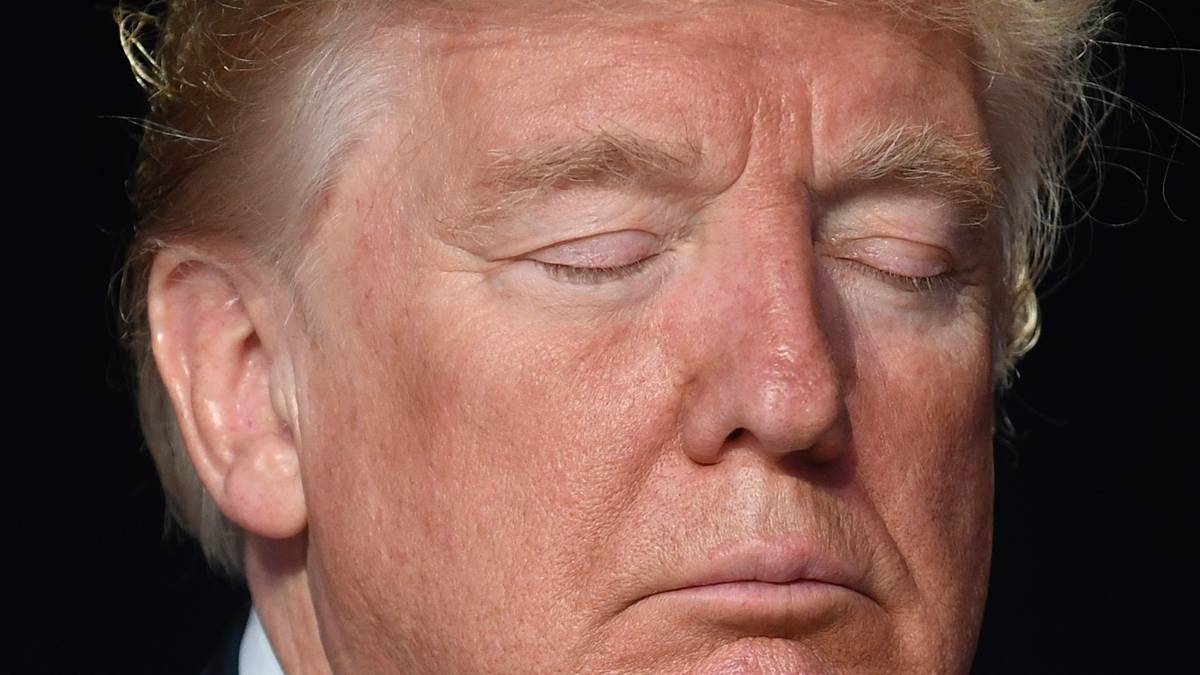

Trump blinks first – global markets exhale after six weeks of economic fever

On the blink. The US and China's trade war is cooling off. Pic via Getty Images

After a frenzied six weeks that left global markets reeling, US President Donald Trump seems to be finally reversing course. Tariffs that were once described as a blunt-force tool to reassert American dominance have been dialled back in a 90-day truce with China.

The move – steeped in political optics but with real economic consequences – has jolted financial markets awake and reset the narrative for investors, traders, and policymakers alike.

This isn’t just a pause. It’s an admission – however carefully disguised – that the tariff blitz launched on “Liberation Day” didn’t produce the leverage or outcomes The White House was banking on.

Trump has blinked first, and in doing so, gave global markets a rare moment of clarity.

The immediate effects were striking. A broad index of dollar strength surged 0.9%, reflecting a sudden rotation back into US assets.

Treasury yields spiked, with the 10-year jumping seven basis points to 4.45%, as investors priced in a renewed growth pulse.

Equities in Europe and the US caught a bid. Risk appetite roared back. Even the yen, a traditional safety play, tumbled as the tone shifted from escalation to de-escalation.

The agreement suspends the vast majority of tariffs imposed in recent weeks, cutting the US rate on Chinese goods to 30% and China’s retaliatory tariffs to 10%.

What had started as a sweeping, near-universal import tax regime on over 60 countries – justified under a fog of strategic language – collapsed into something far more measured.

Markets heard the signal: the White House knows it went too far.

The reality is that the tariff war was never going to achieve its stated aim. It didn’t shift supply chains fast enough. It didn’t collapse China’s resolve, and it certainly didn’t protect American consumers or manufacturers, who were left to absorb soaring costs and massive uncertainty.

Business leaders across the US were already sounding the alarm – and voters were starting to notice the effect on prices.

Trump’s reversal is pragmatic, but it’s also political.

With pressure building, economic instability became a liability. What was sold as strength began to look more like miscalculation – and when financial markets began to teeter – with bond yields tightening and equities shedding trillions in value – the incentive to recalibrate became unavoidable.

This latest pivot isn’t about détente or ideological shift. It’s about control. A roaring stock market and steady macro backdrop remain central to Trump’s appeal. The last six weeks shredded both. The tariff rethink is an attempt to regain momentum – before investors fully price in the damage already done.

But there’s more at stake here than politics. The global economy has been operating in a defensive crouch.

The escalation between the world’s two largest economies threatened to fracture supply chains, freeze investment, and tilt fragile growth stories – particularly in Asia and Europe – toward contraction. That danger hasn’t disappeared, but this truce offers a chance to step back from the brink.

The shift may also recalibrate the Fed’s calculus. With tariff-related inflation risks easing, policymakers could have more room to focus on underlying trends rather than reacting to political volatility.

This could reduce the risk premium currently embedded in rates and offer a stronger foundation for both corporate investment and consumer confidence.

Still, the relief rally must be kept in perspective. This is a temporary pause, not a structural reset. The 90-day window may not be enough to repair the deeper damage to trust and planning that the past month has wrought.

The wildcard remains Trump himself – capable of reversing course with a single post, speech, or flash of temper.

Investors would be wise to treat this moment as an opening, not a resolution. The fever has broken, but the underlying illness—the weaponisation of trade policy, the unpredictability of executive action, the marginalisation of institutions—remains in the system. What this episode proves is that pressure still works, but only when applied relentlessly and across channels.

From an international perspective, this pause is likely to reset capital flows back into risk assets. Emerging markets, which had suffered currency drawdowns and outflows, may see renewed inflows if the dollar stabilises and trade volatility subsides. European manufacturers, many of whom were caught in the crossfire of US tariff policy, now have space to recover margins. Asian supply chains, rattled by weeks of retooling, may cautiously restart operations.

What happens next depends not on the press release, but on follow-through. If the US and China use this window to craft a more targeted and enforceable framework – focusing on areas like fentanyl trade enforcement, tech standards, and fair access – then markets will have a reason to sustain optimism.

If not, the brief euphoria will fade, and the underlying fragilities will return with force.

In the meantime, Trump’s about-face stands as the clearest sign yet that tariffs alone don’t win trade wars. They burn goodwill, spike costs, and they spook markets. And ultimately, they force even the most hardline administrations to confront the limits of economic coercion.

The six-week fever that gripped global markets may be cooling. But the lesson lingers: in a world where uncertainty trades like currency, predictability has never been more valuable.

The views, information, or opinions expressed in the interviews in this article are solely those of the author and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial advice contained in this article.

Nigel Green, is the group CEO and founder of deVere Group, an independent global financial consultancy.

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.