Lunch Wrap: ASX creeps up as Bitcoin soars, uranium stocks blast off

Uranium stocks blast off this morning. Picture via Getty Images

- ASX edges up on Friday morning

- Bitcoin hits $111K as crypto gets cosy with Washington

- ASX uranium stocks go nuclear on Trump’s energy play

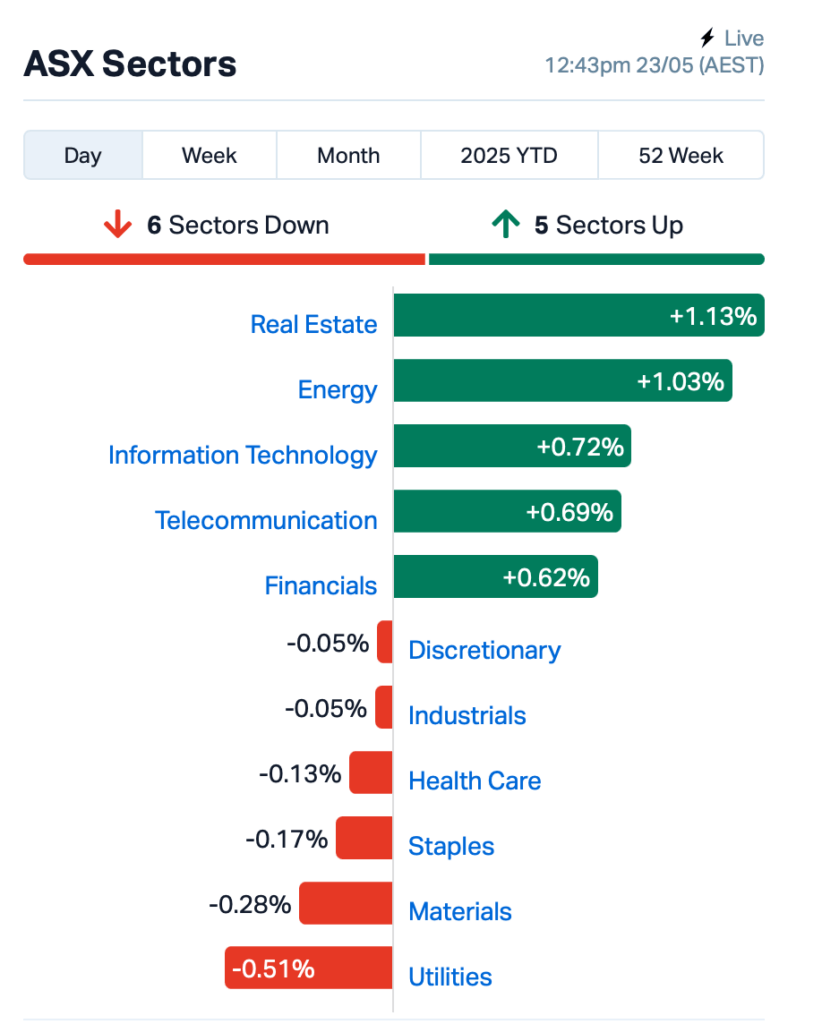

The ASX managed a modest rise of 0.30% by lunch time AEST Friday.

Wall Street set the tone with a seesaw session that ended more or less flat.

The headline overnight was the 10-year US Treasury yield, which dropped 7 basis points to 4.53%. That gave traders a moment to breathe after a hectic week of sell-offs over runaway US deficits.

Meanwhile, Bitcoin is blowing the roof off, smashing through $110,000 for the first time ever and hitting $111,240 at this time of writing.

A couple of things have been fuelling cryptos.

First, a US Senate vote this week moved forward the so-called GENIUS Act, an industry-backed bill that could finally give crypto some clear rules.

Second, when faith in the US dollar wobbles, as it is now, some investors start hunting for safe-haven alternatives, and Bitcoin’s looking like the new gold for a few more people.

Back home, the big boom this morning came from uranium stocks, which are absolutely lighting up the ASX board.

Word is that Trump’s about to sign executive orders to give America’s nuclear sector a big adrenaline shot.

According to sources, these orders would declare a national emergency, and unleash the Cold War-era Defence Production Act.

This would send both the Department of Energy and Defence off to scout for nuclear-ready land and fast-track approvals for next-gen reactors.

Paladin Energy (ASX:PDN) rocketed 8% on the news, Boss Energy (ASX:BOE) surged over 12%, and Deep Yellow (ASX:DYL) blasted up 8.3%.

In large caps new, Rio Tinto (ASX:RIO) announced that its CEO Jakob Stausholm is stepping down later this year.

After steering the company through a turbulent few years, Stausholm will only hang around until Rio finds a replacement. Chairman Dominic Barton says Rio’s strategy will stay the same, it’s just time for new hands on the wheel.

Rio’s shares were down 1%.

And, engineering company Duratec (ASX:DUR) got smashed 5.5% after trimming its full-year revenue forecast, blaming slow project awards and bad weather.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 23 [intraday]:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| RPG | Raptis Group Limited | 0.025 | 79% | 400,000 | $2,454,864 |

| BMO | Bastion Minerals | 0.002 | 50% | 1,795,015 | $903,628 |

| LNR | Lanthanein Resources | 0.002 | 50% | 400,000 | $2,443,636 |

| MOM | Moab Minerals Ltd | 0.002 | 50% | 1,042,927 | $1,733,666 |

| LKY | Locksley Resources | 0.045 | 36% | 8,175,905 | $4,840,000 |

| CTO | Citigold Corp Ltd | 0.004 | 33% | 261,227 | $9,000,000 |

| ASR | Asra Minerals Ltd | 0.003 | 25% | 272,810 | $5,533,072 |

| BPP | Babylon Pump & Power | 0.005 | 25% | 8,000,000 | $11,082,268 |

| CAV | Carnavale Resources | 0.005 | 25% | 16,666 | $16,360,874 |

| EVR | Ev Resources Ltd | 0.005 | 25% | 500,000 | $7,943,347 |

| DUB | Dubber Corp Ltd | 0.018 | 20% | 14,439,119 | $39,350,512 |

| REC | Rechargemetals | 0.018 | 20% | 710,033 | $3,854,850 |

| G50 | G50Corp Ltd | 0.120 | 20% | 546,576 | $16,059,766 |

| CCO | The Calmer Co Int | 0.003 | 20% | 1,351,982 | $7,528,289 |

| FBR | FBR Ltd | 0.006 | 20% | 4,006,930 | $28,447,261 |

| AKN | Auking Mining Ltd | 0.007 | 17% | 100,000 | $3,448,673 |

| DTI | DTI Group Ltd | 0.007 | 17% | 1,300,000 | $2,691,308 |

| GLL | Galilee Energy Ltd | 0.007 | 17% | 100,000 | $4,243,157 |

| TYX | Tyranna Res Ltd | 0.004 | 17% | 324,000 | $9,865,276 |

| TMG | Trigg Minerals Ltd | 0.063 | 17% | 28,814,795 | $49,888,974 |

| MVL | Marvel Gold Limited | 0.016 | 14% | 1,459,235 | $15,116,337 |

| AWJ | Auric Mining | 0.215 | 13% | 62,759 | $28,301,140 |

| SLA | Solara Minerals | 0.130 | 13% | 56,884 | $6,668,255 |

| MGU | Magnum Mining & Exp | 0.009 | 13% | 151,091 | $8,973,207 |

Locksley Resources (ASX:LKY) is sending its exploration team to the Mojave Project in California this June, ahead of expected drill permit approvals. It’s prepping for a September quarter drill campaign targeting rare earths and antimony, with up to 12.1% TREO and 46% Sb reported at key sites. The project sits near MP Materials’ Mountain Pass Mine and includes the historically high-grade Desert Antimony Mine.

Auric Mining (ASX:AWJ) has locked in $6.66 million through a strongly backed share placement at 18 cents a pop, bringing in new funds and fresh support from existing holders. The cash injection gives it the firepower to wrap up its Burbanks Gold Facility deal, and finalise the Lindsay’s Project, home to the Parrot Feathers Gold Mine. With gold prices flying near record highs, Auric reckons the timing’s perfect to ramp up production.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 23 [intraday]:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| FTC | Fintech Chain Ltd | 0.002 | -67% | 2,789,514 | $3,904,618 |

| ALR | Altairminerals | 0.002 | -33% | 1,756,764 | $12,890,233 |

| VML | Vital Metals Limited | 0.002 | -33% | 21,725,645 | $17,685,201 |

| GMN | Gold Mountain Ltd | 0.002 | -25% | 310,989 | $10,267,776 |

| OVT | Ovanti Limited | 0.003 | -25% | 378,539 | $11,174,060 |

| OCN | Oceanalithiumlimited | 0.054 | -21% | 249,122 | $9,349,754 |

| CHM | Chimeric Therapeutic | 0.004 | -20% | 5,507,697 | $9,253,431 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 130,675 | $23,423,890 |

| APC | APC Minerals | 0.009 | -18% | 17,205 | $3,222,267 |

| FDR | Finder | 0.041 | -18% | 2,088 | $14,214,416 |

| IG6 | Internationalgraphit | 0.047 | -18% | 282,890 | $11,032,825 |

| ANR | Anatara Ls Ltd | 0.005 | -17% | 510,625 | $1,280,302 |

| BUY | Bounty Oil & Gas NL | 0.003 | -17% | 502,755 | $4,684,416 |

| TRI | Trivarx Ltd | 0.010 | -17% | 4,748,466 | $7,408,730 |

| RAU | Resouro Strategic | 0.170 | -15% | 25,780 | $8,357,564 |

| CRR | Critical Resources | 0.003 | -14% | 63,000 | $9,149,774 |

| DTM | Dart Mining NL | 0.003 | -14% | 100,000 | $4,193,195 |

| GCM | Green Critical Min | 0.012 | -14% | 2,142,221 | $27,484,496 |

| OLI | Oliver'S Real Food | 0.006 | -14% | 1,663 | $3,785,123 |

| PV1 | Provaris Energy Ltd | 0.010 | -14% | 770,153 | $7,678,014 |

| NPM | Newpeak Metals | 0.013 | -13% | 539,357 | $4,831,076 |

| ICR | Intelicare Holdings | 0.007 | -13% | 834,607 | $3,889,505 |

| RMX | Red Mount Min Ltd | 0.007 | -13% | 221,816 | $3,719,662 |

| SER | Strategic Energy | 0.007 | -13% | 129,502 | $5,368,267 |

IN CASE YOU MISSED IT

West Coast Silver (ASX:WCE) is gearing up for a diamond drilling program at the Elizabeth Hill project in WA. The company is targeting down-plunge extensions to silver mineralisation, focusing on high-grade zones.

At Stockhead, we tell it like it is. While West Coast Silver is a Stockhead advertiser, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.