RBA cut could spark a property supercycle, and land us in the ‘winner’s curse’

Is the Australian property market about to enter a “supercycle”? Pic: Getty Images

- Rate cuts could swing the gates open for property buyers

- Next property supercycle might already be warming up

- Aussie market may be smack in the “winner’s curse”

Unless you’ve been blissfully ignoring expert comments, you’ve probably heard that an RBA rate cut is looking locked in for May 20.

NAB is predicting five cuts this cycle: a chunky 50 basis point (0.50%) cut in May, with more to follow in July, August, November, and February next year.

In total, these cuts could drag the cash rate down to 2.6% (from the current 4.1%) according to NAB, carving a neat $526 off monthly repayments for the average $600,000 loan.

If this plays out, investment adviser George Markoski told MacroBusiness it could open the “biggest floodgates in the history of the market”, saying there’s a wall of buyers just itching to jump in.

Diaswati Mardiasmo at PRD Real Estate agreed, adding in her Linkedin post, “it seems like there is large section of the market waiting for the gun to go off.”

Some experts believe this could even be the spark that sets off Australia’s next property supercycle.

The 18.6-year land cycle

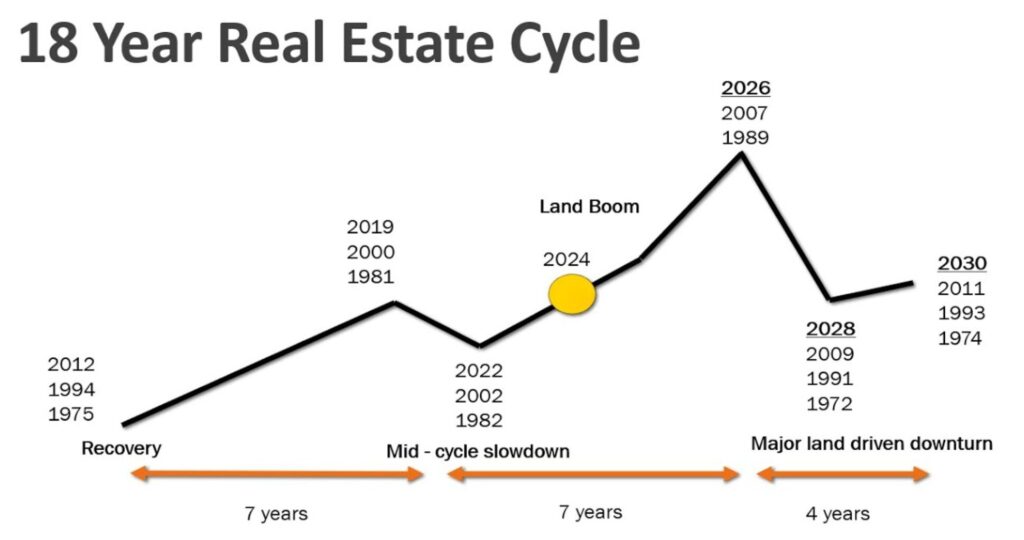

The supercycle is part of what’s called an “18.6-year land cycle.”

It sounds like something out of a dusty economics textbook, but the 18.6-year land cycle is actually a much researched theory.

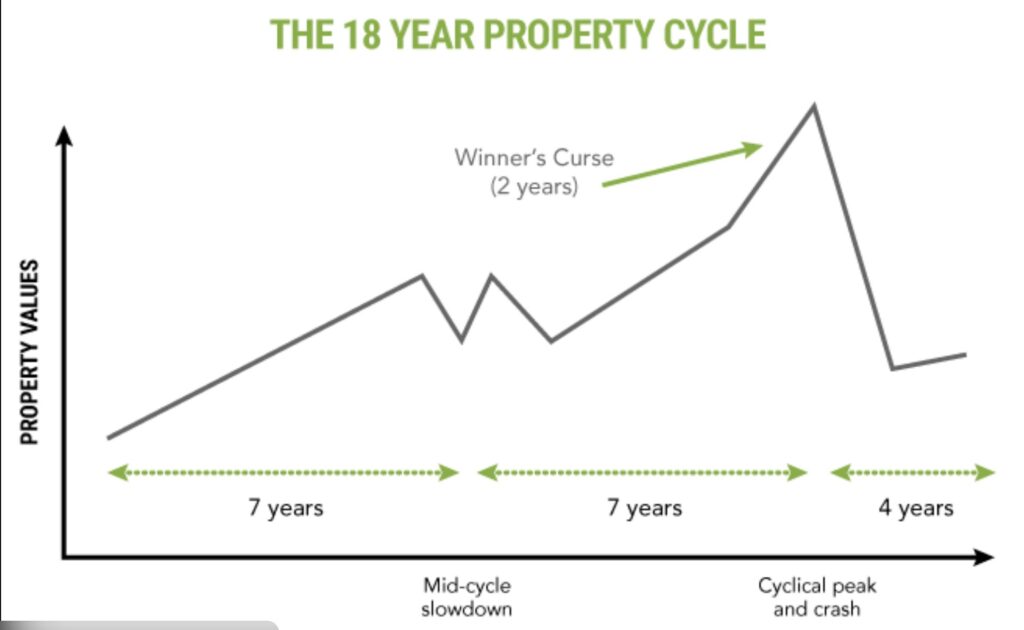

The theory goes that every 18-ish years, property markets go through a big, predictable loop: A long stretch of growth, then a wobble, then a crash, then we rinse and repeat.

The boom phase can last about 14 years, with prices climbing, credit flowing, and everyone feeling like a genius investor.

Until it hits what’s called the “winner’s curse,” the part of the cycle, also called a supercycle, where prices go through the roof.

This is when everything lines up just right: low interest rates, high demand, and a supply crunch that makes every piece of land look like gold.

Then comes the 4-year hangover: a sharp correction, sometimes a full-blown crash, followed by a sluggish recovery.

Eventually things stabilise, affordability improves, and the whole ride starts again.

There’s actually data on this that stretches back over a century.

And according to that data, the Aussie market should currently be smack-bang in the middle of that winner’s curse.

So why call it a “winner’s curse”?

Because this is the point where everything looks too good to be true. Prices are flying, everyone’s piling in, and FOMO is at fever pitch.

But here’s the catch: those who jump in without a plan often find themselves caught out when the music stops.

During this cycle, it’s easy to pay too much and end up on the wrong side of the market when things cool off, warned Ravi Sharma, an Aussie property expert and founder of Search Property.

“Some would argue that we’ve already entered the winner’s curse,” Sharma said in his podcast called Personal Finance with Ravi Sharma.

“And some people will argue it [property price] can’t go up forever, but it’s the same way that you view your income.

“It can’t keep going up forever, well, yes it can, because the currency (in which) you’re denominating that is being debased.”

What should investors do now?

Sharma highlights that more people want to live in Australia, while property supply has been choked by rising construction costs and insolvencies across the building sector.

Less supply, more demand, it’s basic economics, but when interest rates are cut, it’s like pouring petrol on a fire.

It’s why he believes this supercycle is just getting started.

And Sharma has his philosophy when it comes to property investment – if you’re priced out of one market, you don’t sit around waiting for it to change, you move to another.

For him, it’s not about being tied to one postcode or one city, warning about the dangers of hesitation in hot markets.

“This is why I like being a borderless investor,” he explained.

“In a market that we’re about to see in the next 12 months, we’re going to miss out on so many properties because some people are willing to pay way above the market rate.

“And some people will just move faster than you can.”

But a note from Property Planning Australia offers a more cautious tone.

“Planning and preparation is a sure-fire way to avoid feeling concern that you’ve overpaid,” the note said.

“And it’s important to remember that if you’re in it for the long-haul, the property market is forgiving if the property is held for many years to come.”

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.