Nordic Resources adds nearly 1Moz gold to inventory after completing Finnish acquisition

Nordic Resources has acquired the Kopsa, Kiimala Trend and Hirsikangas gold projects in Finland. Pic: Getty Images

- Nordic Resources has completed the acquisition of three Finnish projects with nearly 1Moz of gold equivalent in store thus far

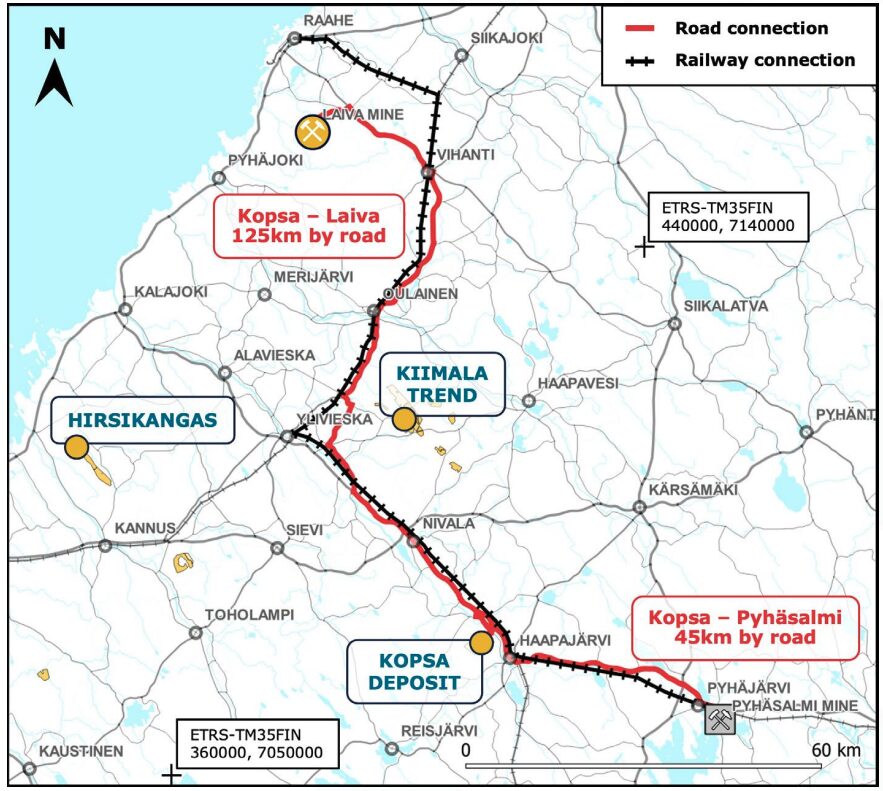

- Projects sit within 50km of each other in the underexplored Middle Ostrobothnia gold belt with nearby processing plants

- Drilling at Kopsa coming soon to test additional prospectivity along strike and below current resource

Special Report: Nordic Resources has wrapped up the acquisition of three projects in Finland that collectively host close to 1Moz of gold equivalent after paying the vendor Northgold about $325,000 in cash and 70 million in company shares.

The Kopsa, Kiimala Trend and Hirsikangas projects sit within 50km of each other in the underexplored Middle Ostrobothnia gold belt of central Finland, which is also home to two existing processing plants that provide options for toll treatment alongside the standard “stand-alone” plant option.

Kopsa – the lead project of the trio – already hosts a near-surface gold-copper resource of 23.2Mt grading 1.09g/t gold equivalent, 69% of which is in the higher confidence indicated category.

Kiimala Trend is shaping up to be a significant project for Nordic Resources (ASX:NNL) after a review of historical data found the Angesneva prospect – one of eight drilled and four undrilled prospects along a discontinuous 15km trend – had enough certainty for the definition of a JORC-indicated resource of 3.85Mt at 1.19g/t gold, or 147,000oz of contained gold.

Another prospect on the Kiimala Trend – Vesipera – also holds a non-JORC resource, though this was found to require more drilling before it can be brought up to JORC compliance.

The same is true of the Hirsikangas project, which is also known to host gold mineralisation with data validation and resource modelling currently underway.

Watch: Nordic’s Rob Wrixon joins Stockhead TV to discuss the acquisitions

Regional prospectivity

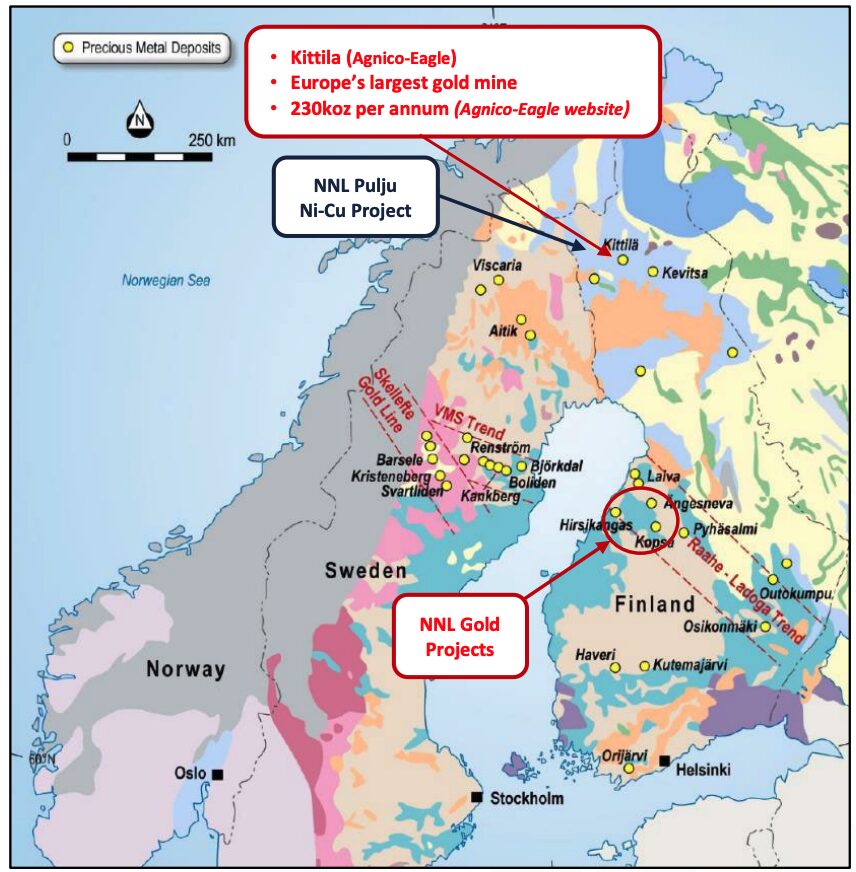

Finland hosts Europe’s largest gold mine, operated by Agnico Eagle.

The Middle Ostrobothnia gold belt itself is also highly prospective as it contains a number of gold and base metal deposits, structurally controlled by the Raahe-Ladoga Trend.

It represents a geological extension to the Gold Line and associated VMS trend seen in neighbouring Sweden.

While the Swedish part of this geological formation has seen significant historical exploration expenditure over the past centuries, the Finnish portion has seen just a fraction of this leaving it relatively underexplored.

As such, the newly acquired gold (and copper) projects provide NNL with substantial near-term exploration and development upside while it continues ongoing earn-in and joint venture discussions relating to its extensive Pulju nickel copper sulphide exploration project in Finnish Lapland.

The company is already preparing to launch drilling at Kopsa by the end of July 2025 with historical work and more recent geophysics indicating the potential for additional mineralisation along strike and beneath the existing resource.

Drilling will also test prospects at Kiimala Trend with Vesipera singled out for attention due to the potential to upgrade the existing resource to JORC compliance.

This article was developed in collaboration with Nordic Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.